Transparent Insurance

Real-time risk exposure, bespoke, transactional, and usage-based coverage embedded within

connected mobility platforms

Yesterday’s insurance wasn’t built for the connected mobility era. It’s based on factors that are less relevant when we want to predict risks derived from the unique business models used by digital platforms and marketplaces”

How do you transfer insurance from the old to something new, relevant, and deliver real value?

Leveraging the power of AI and data

Smart Insurance Tailored to the needs of today’s smart mobility landscape

Cost-Effective Helps clients achieve up to 30% savings on insurance expenses

Intelligent Risk Analysis Deep learning algorithms assess journey-specific risks

Insurance Gateway Leverage smart vehicle data, build driver profiles, and connect to multiple insurers for personalized coverage

CONTEXTUAL UNDERWRITING WITH GRANULARITY

Delivering real-time, highly accurate insurance premiums for Connected MaaS means that we crunch more data than anyone today. Our proprietary AI, data-driven platform makes the seemingly impossible clearer, uncovering the true risk of insurance.

What does that look like?

We're glad you asked

Our powerful AI gathers data points based on various factors associated with your business. Take Last-Mile Delivery. We collect a driver’s age, gender, weight, experience and driving behavioral history

This is just the beginning. We also draw on vehicle telematics data. We’ll know which make and model of vehicle is used, when it was last serviced, its GPS coordinates on route to its destination, its speed, and where it will be used. But that’s not all, we’ll also add context. We factor in the weather, calendar and city events, and additional location information.

Contextual Underwriting

This data, along with historical data and market statistics is then fed to our AI, rule-based underwriting platform to deliver truly granular and transparent insurance premiums in real-time.

Rider/Driver

Vehicle and Telematics

Other

Age

Weight

Experience

Driving behavior

And more

Vehicle and telematics

Manufacture

Model

Version

Last maintenance

GPS coordinates of the route

Weather

Calendar events

City events

Location information

Historical data and market statistics

Rental sessions: Vehicle driver telematics and location

Data enrichment: Weather and location information

Rule based underwriting

Al powered continuous underwriting

Claims

Transparency Identifies True Risk Cost

As unique as MaaS and Connected Fleets are, they also make establishing the true profitability of your business murkier. Without granularity, you’ll never know which types of rides, in which areas, and under what conditions are bad for business.

With Connected Insurance, your entire operation benefits from complete transparency. Deeper, data-driven risk assessments help identify higher-risk rides, allowing you to steer your business towards cover for lower-risk rides and a more profitable bottom line.

For MaaS and Beyond

Use Cases

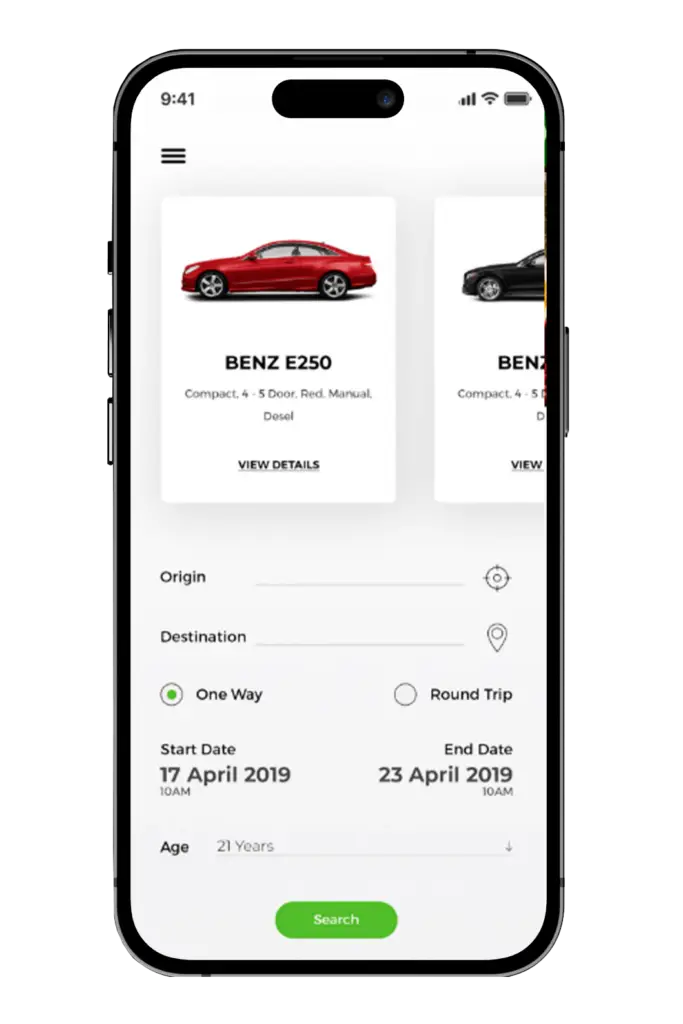

Embedded Motor Insurance

Allow your clients / Users a seamless experience including insurance coverage Access tailord insurance that meets your end clients needs and costs based on your

Accurate Personal Accidents

Save up to 30% of your fleet insurance cost with risk-driven insurance Access Connected Claims for full transparency and easy to use claim filing system

Data Driven Usage Based Fleet Liability Insurance

Save up to 30% of your fleet insurance cost with risk-driven insurance Accesses Connected Fleet management and Connected claims for full transparency

Need a tailored solution?

Tell us about it.

Our technology is flexible enough to integrate into more businesses and deliver the same level of unprecedented transparency for bottom-line results. To find out how we can help your organization, schedule your meeting today.

A Real-time Data-Driven Dashboard

Digital Claims Management

Policy

Management

Risk Dashboard

Embedded Insurance

Self Insurance Management

Learn about the value digital platforms, insurers and brokers can experience by switching to data-driven, usage-based insurance for the MaaS and Fleets

MaaS

Insurers

Brokers

Want to really understand your risk exposure?

Uncover your true loss cost is by scheduling a call with us. We’ll show you how implementing our powerful AI, data-driven, rule-based underwriting solution can transform your approach to MaaS and Fleets insurance from old and blurry into real-time and transparent.